Investment Solutions

Shaw and Partners assists clients with asset selection of a wide range of investments including shares, cash, bonds, fixed interests and managed funds.

Domestic Shares

Shaw and Partners specialises in buying and selling shares for clients in listed companies on local exchanges such as the ASX. All our Advisers have access to the latest information technology systems and research services which allow them to provide you with timely, expert advice.

International Shares

Through our arrangements with international brokers, Shaw and Partners can provide you with access to international shares offering you the opportunity to invest in the world’s biggest companies. Investing in international shares can provide you with greater diversification in your portfolio and give you access to sectors which are poorly represented in the Australian market.

Cash, Corporate Bonds and Fixed Interest Products

Cash, corporate bonds and fixed interest products allow investors with a low risk appetite, greater capital security than investing in most shares but generally provide better returns than basic bank savings accounts. Shaw and Partners can provide you with access to a variety of cash products including cash management accounts, term deposits and corporate bonds.

Managed Funds

Shaw and Partners provides access to a range of managed funds. Investing in managed funds allows you to pool your money with other investors, diversify your portfolio and access a wider range of investment opportunities. Such wider investment opportunities include access to international markets, hedge funds and infrastructure funds.

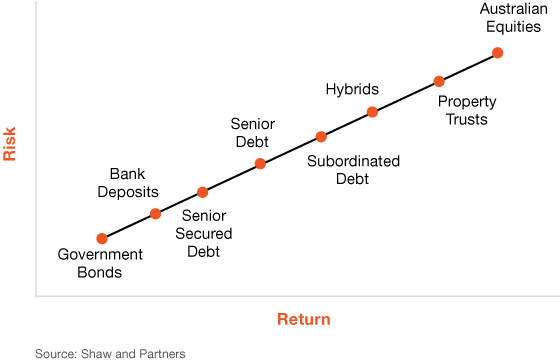

Risk versus Return graph

We provide tailored investment management services to help clients manage and grow their wealth.